Tax Base Erosion and Profit Shifting (BEPS) in Mining | International Institute for Sustainable Development

ADDRESSING BASE EROSION AND PROFIT SHIFTING (BEPS) Pascal Saint-Amans Director, CTPA, OECD. - ppt download

PDF) HSTCQE=V^W[ZW: isbn 978-92-64-19265-2 23 2013 15 1 P Addressing base Erosion and Profit shifting Contents | Alem Zeballos - Academia.edu

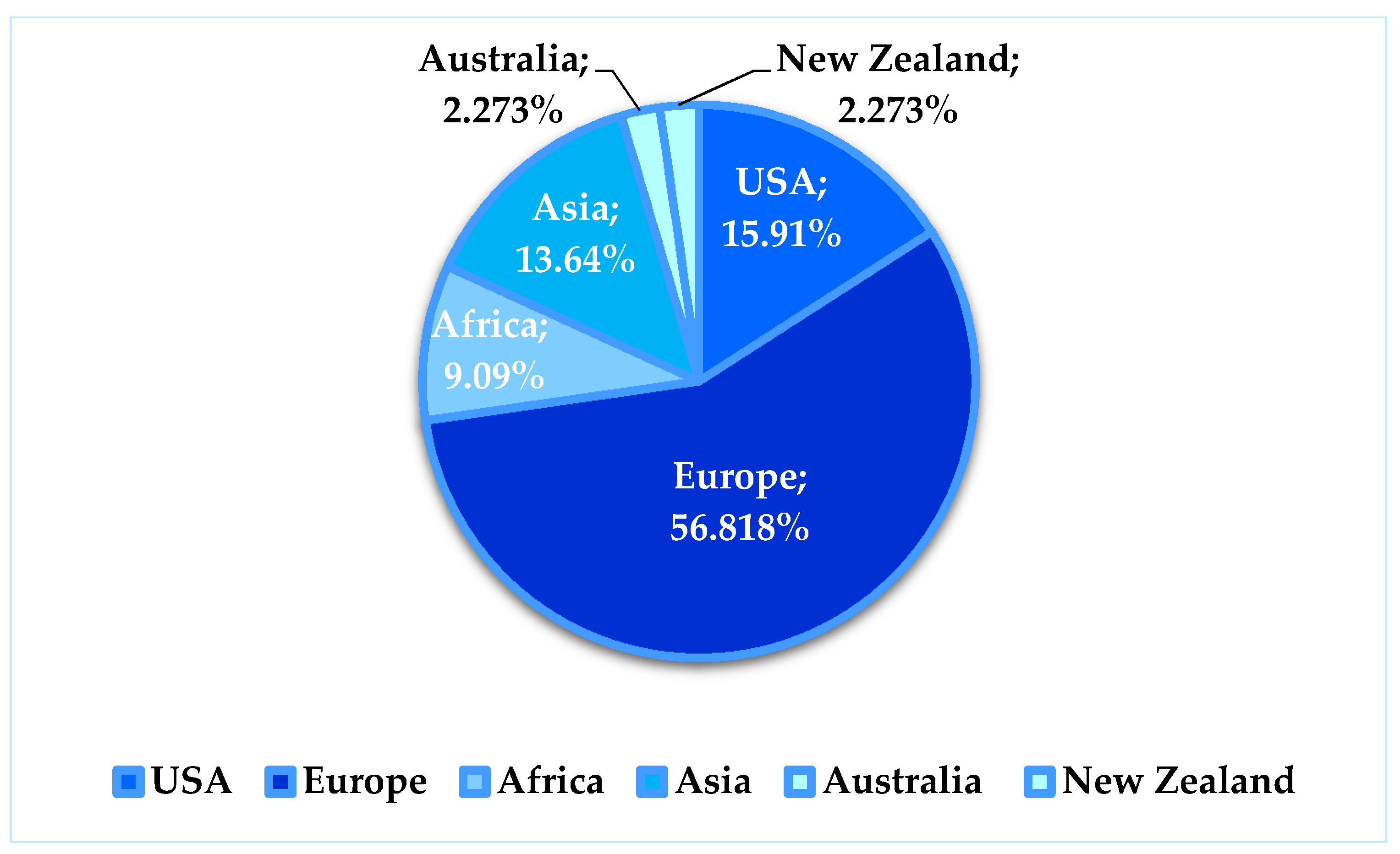

Sustainability | Free Full-Text | Sustainability Assessment: Does the OECD/G20 Inclusive Framework for BEPS (Base Erosion and Profit Shifting Project) Put an End to Disputes Over The Recognition and Measurement of Intellectual

OECD/G20 Base Erosion and Profit Shifting Project Countering Harmful Tax Practices More Effectively, Taking Into Account Transparency and Substance (Paperback) - Walmart.com

BASE EROSION AND PROFIT SHIFTING. Overlap of tax sovereignties may lead to double taxation Core work of the OECD is to remove barriers to cross-border. - ppt download

Oecd/G20 Base Erosion and Profit Shifting Project Addressing the Tax Challenges of the Digital Economy, Action 1 - 2015 Final Report: Organisation For Economic Co-Operation And Development, Oecd: 9789264241022: Amazon.com: Books

Base Erosion and Profit Shifting ((BEPS) | Deloitte | Tax Services | International Tax |Insights | Article

OECD/G20 Base Erosion and Profit Shifting Project Developing a Multilateral Instrument to Modify Bilateral Tax Treaties, Action 15 - 2015 Final Report (Paperback) - Walmart.com

Limiting Base Erosion Involving Interest Deductions and Other Financial Payments Action 4 – 2016 Update

A Handbook On Base Erosion And Profit Shifting-Addressing Global Tax Avoidance : C.A. Akshay Kenkre: Amazon.in: Books

BEPS (Base Erosion and Profit Shifting) Action 13 – Country by Country Reporting | Tayros Consulting