Deferred tax related to assets and liabilities arising from a single transaction (Proposed Amendments to IAS 12) Issues Paper

Module 3 Activity 1 - Lecture notes assignment - 1. What entities are required to report deferred - StuDocu

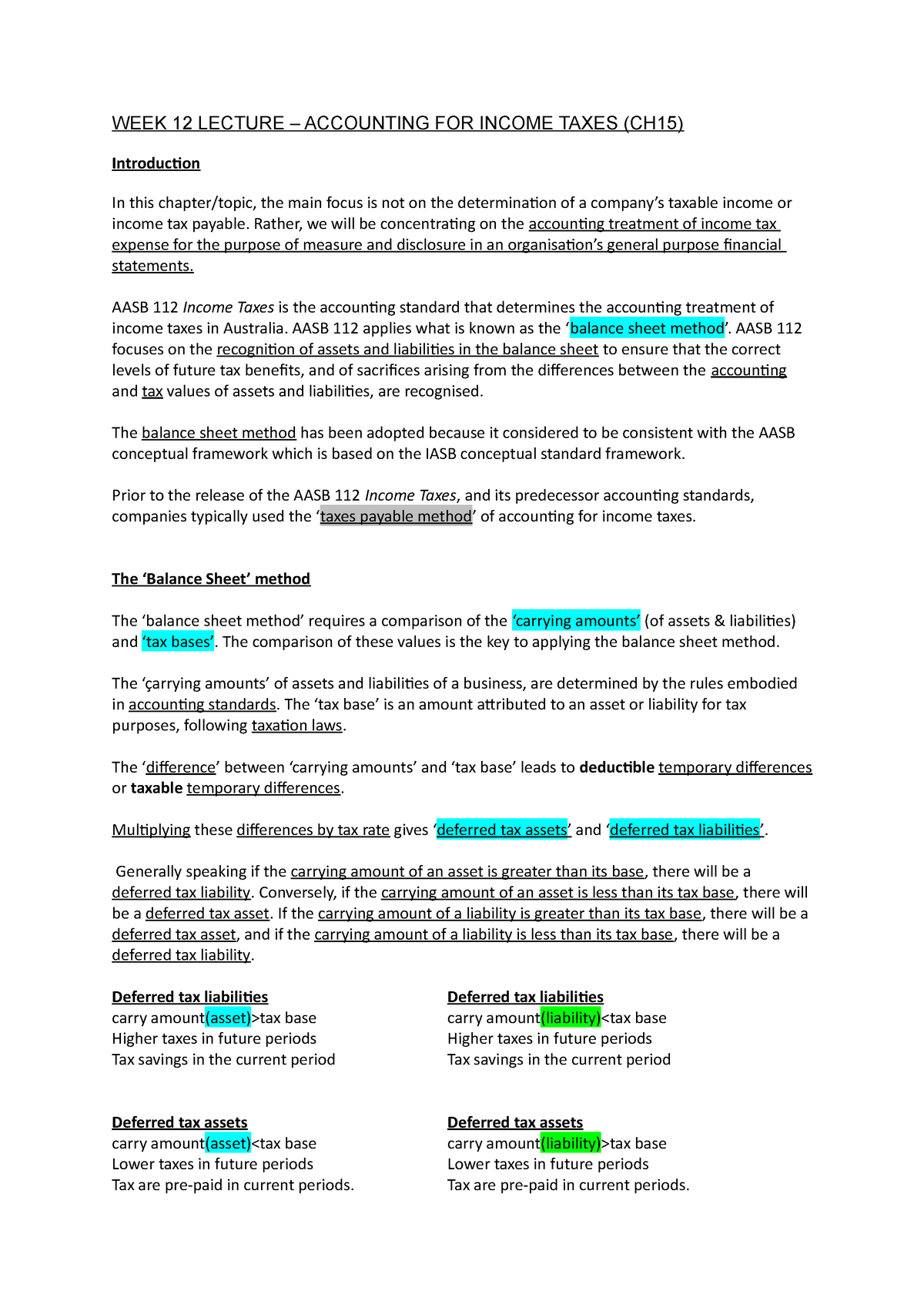

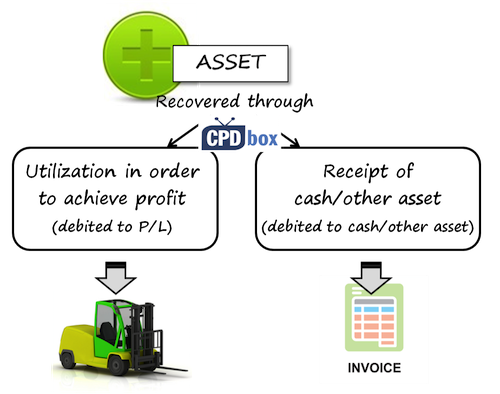

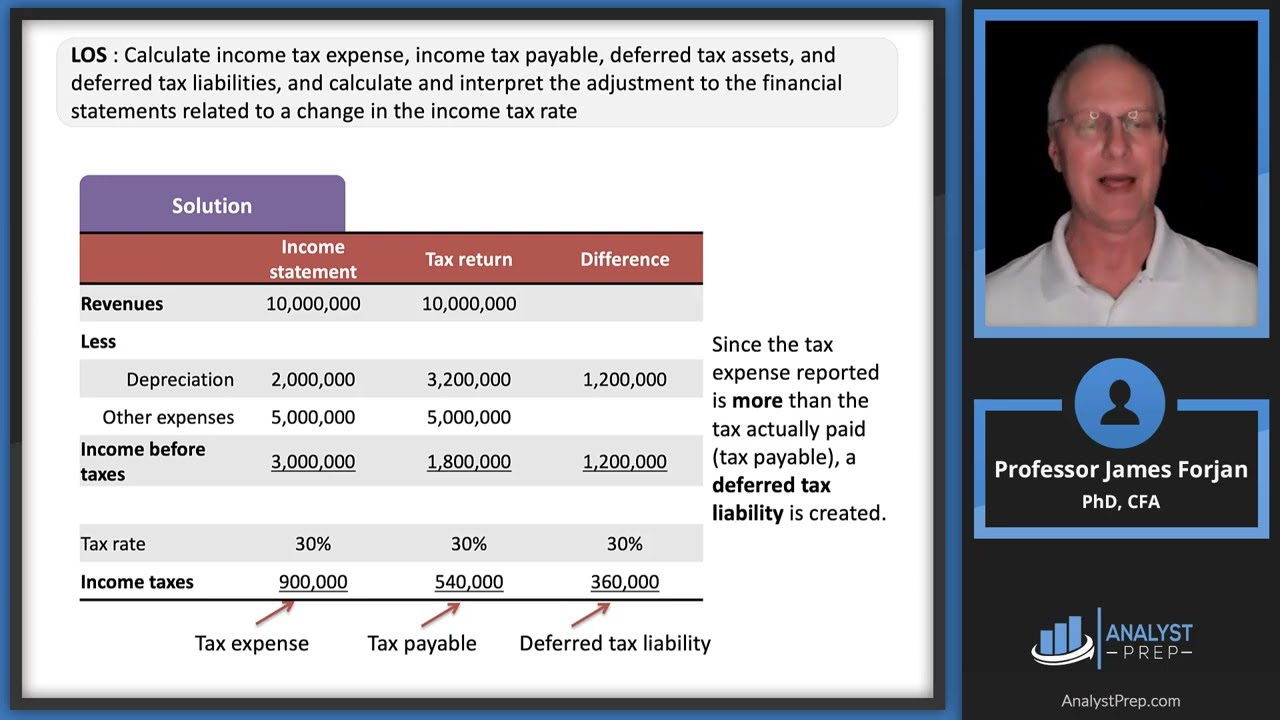

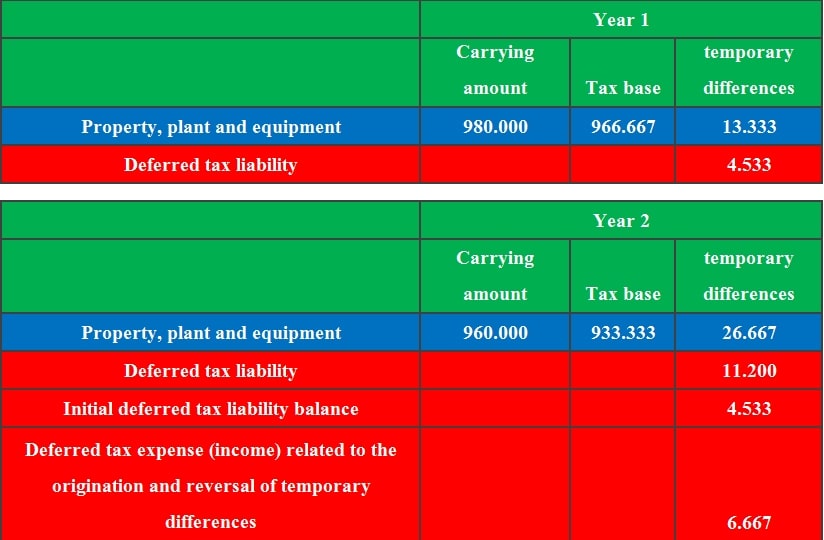

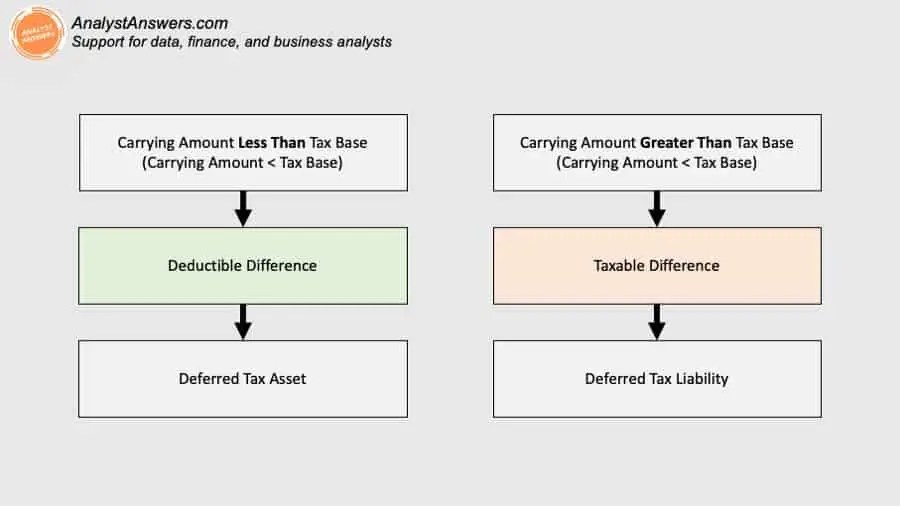

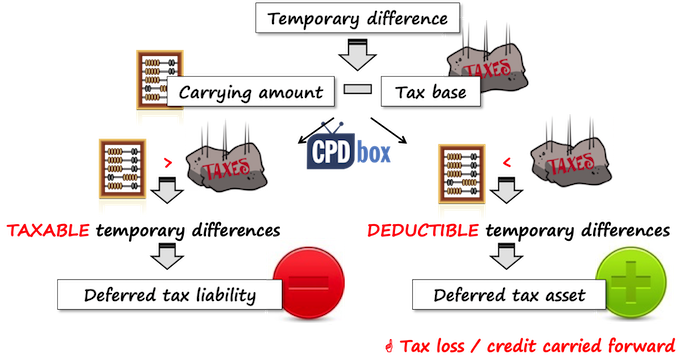

Cacique Accounting College - Today's topic - ACCA P2 - Corporate Reporting - Deferred Tax…😊 A Deferred Tax liability is an account on a company's Balance Sheet that is a result of